Southfield by Radical Forge

2024 Unity Gaming Report

Seismic changes are reshaping the game development landscape. On one hand, games have greater cultural impact than ever: More people are playing bigger hits on increasingly powerful hardware; film and media adaptations of game IPs are crushing both box office figures and critical reception; and, as a broad category, video games have been out-earning film and music for years.

On the other hand, the industry has been plagued by deep cuts, layoffs, and studio closures. Tried-and-true business models seem shaky in the face of changing ad dynamics and stagnant post-pandemic revenue. Last year felt especially tumultuous as high interest rates made investors hesitant, new tools changed production capacities, and many players stayed busy with IRL activities.

In spite of the headwinds caused by structural changes in the economy and gaming business, the long-term future of the gaming industry seems bright. While these shifts are playing out, though, studios need to read the signs and adapt to remain competitive.

Most devs just want to stay head down and focus on projects. But thriving in a challenging market means getting ahead of trends to plan effectively, maximize resources, launch on time, and play the long game. Working smarter requires low-risk tactics that improve the chances for success.

Our data shows gamedevs navigating challenges and adapting to changes in technology, the economy, and player habits by doing more with less. Studios are stretching the value of their IPs, boosting productivity using AI tools, squeezing more revenue from diverse ad strategies, and doubling down on safe bets like multiplayer games and multiplatform reach.

This guide draws on data from approximately five million¹ Unity Engine developers and over 342 billion² ad views. Analysis also integrates insights from polls, surveys, and Unity’s broad community of industry veterans, studio partners, and in-house experts to enable better strategic planning.

Read on to find data-backed trends, practical tips from studios, and actionable insights on how to use this information effectively in development planning and operations.

Sunshine Island by New Moon Production

These are the trends shaping game development

Devs are adopting AI tools to save time.

Studios are diversifying their revenue approaches.

Studios of all sizes are shipping to more platforms.

Devs prioritize multiplayer games despite greater complexity and cost.

The industry is building stronger brands by extending engagement.

About the data

The data in this report is drawn from the Unity Engine, Unity Cloud, and ironSource from Unity portfolio of products, including games made with Unity that are sending events through the platform. These solutions span mobile, PC, and console gaming, giving a unique high-level overview of the industry.

Additional data for this report comes from a survey of game developers who were invited to participate via various means such as social media advertisement, Unity customer emails, and community channels. In total, 300 respondents completed the Cintᵀᴹ survey with a margin of error of +/-6%.

Other data sources include The Harris Poll’s The State of Toxicity & Cross-Platform Play in Today’s Multiplayer Games: 2023 Edition, a Unity-procured survey of 407 developers with a margin of error of +/-5%. As well, there was a Unity Sentis beta user survey of 7,062 respondents with a margin of error of +/-2%, an asset management collaboration survey of 120 developers performed by Unity with a margin of error of +/-9%, and a 2023 Statista Digital Market Insights report.

We take data privacy seriously and have omitted and anonymized information from this report that would individually identify any single game, developer, or publisher. Games are broken out into publicly available categories as defined on the iOS and Google Play stores where available. Although we also include outside sources of information, the data shown in the charts and graphics is original to Unity. In addition, we are grateful to those members of the industry whom we interviewed for this report, many of whose contributions are quoted throughout.

Here’s how we grouped studio sizes for this report:

Indie: 1–9 people

Midsize: 10–49 people

Lower midmarket: 50–149 people

Upper midmarket: 150–299 people

Large studios: 300+ people

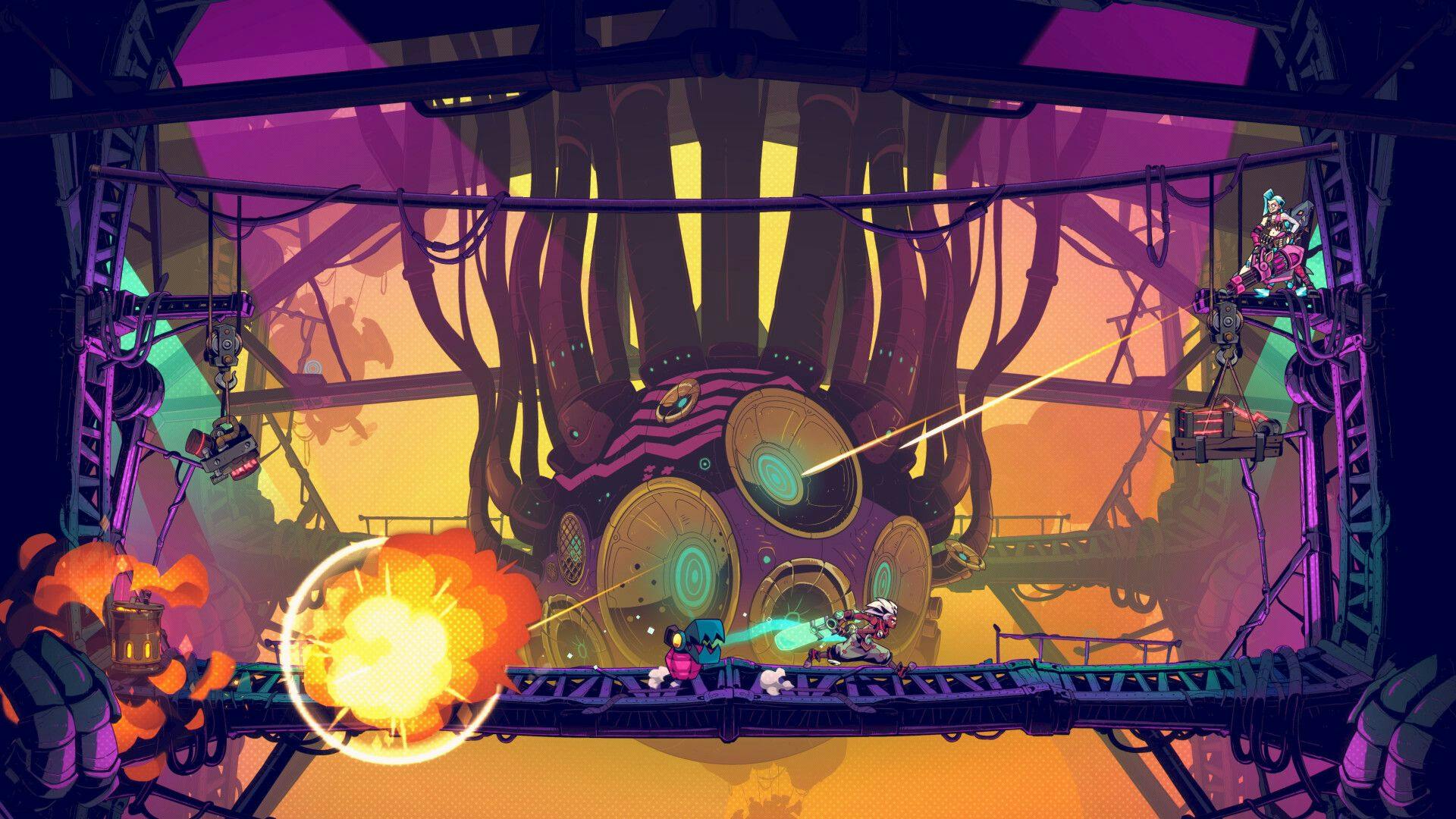

CONV/RGENCE: A League of Legends Story by Double Stallion Games

Devs are adopting AI tools to save time.

The average time to launch for games increased from 218 days in 2022 to 304 days for 2023⁴. Studios are spending more time in development before earning returns on their investments, and they need to find ways to get to market faster. But exploring tools to speed up production comes with challenges. As Chart 1.1 shows, 40% of the studios surveyed face long R&D times while trialing new technologies, and 37% say they struggle to integrate and manage their tools and systems.

- 1.1 Studios face challenges when adopting new technologies.

- 1.2 Studios are using AI for content creation and animation improvement.

- 1.3 Most developers have a short window for prototyping.

- 1.4 Textures and materials are the most-used premade assets.

- 1.5 Developers harness AI to create NPCs.

- 1.6 AI is most commonly used for AR/VR and online multiplayer games.

- 1.7 Lack of time or know-how is the biggest blocker to AI tool adoption.

- 1.8 Studios work with a lot of assets.

- 1.9 A look at how studios spend time dealing with assets.

- 1.10 Version control is the most prized feature of a Digital Asset Management (DAM) solution.

- 1.11 DevOps tools support code safety and stability.

1.1: Studios face challenges when adopting new technologies.

Encountering long R&D times while trialing new technologies

Managing and integrate tools and systems

Keep project organized, in scope, and on time

Collaborating as a distributed/hybrid team

I don’t have enough time

Players are setting the bar higher these days, and this has an impact on production. Studios need to make sure that they can actually reach the expectations of those players, and production becomes more costly and takes more time.

Breachers by Triangle Factory

As they look to shave time off the game development cycle, many are excited about AI tools and the potential efficiencies they offer.

In 2023, a Unity study⁵ showed that 71% of the studios that are using AI say that it’s improved their delivery and operations.

Chart 1.2 shows that 37% of surveyed devs say they are using AI to accelerate writing code, while 36% are generating artwork and game levels, testing gameplay loops, and automating narrative elements.

1.2: Studios are using AI for content creation and animation improvement.

Improving character animations

Writing code/speeding up code writing

Generating artwork and game levels

Writing and narrative design

Automated play testing

Adaptive difficulty

In-game text and voice chat moderation

I am experimenting with AI. There are many disciplines that go into making a game, and I am trying to understand how each and every one of them can benefit from it, like tools that can aid prototyping and content generation, level design, and narrative. I think there’s a whole universe that goes into workflows and analysis of data and analytics, so there’s so much that can be done with AI that can boost productivity at every level.

1.3: Most developers have a short window for prototyping.

Under a week

Under a month

Under three months

Over six months

Starting a game from scratch is exciting for most developers, but it can also be daunting.

Ideation comes with a lot of brainstorming and false starts exploring gameplay loops. In a 2023 survey⁶, 68% of developers who use AI counted its ability to accelerate prototyping and concepting work as one of their main reasons.

As game development schedules get longer, devs hope that quick conceptualization will either shorten shipment cycles or give them more time to focus on optimization and strategy planning. Chart 1.3 shows that in 2023, 96% of the studios polled were spending three months or less prototyping, compared to 85% of studios in 2022.

My Talking Tom Friends by Outfit7 Limited

I’ve used AI for quick prototypes when I wanted to test out something without writing any boilerplate code. It was super useful for me.

1.4: Textures and materials are the most-used premade assets.

Textures and materials

Scripts and code

3D assets for games

Animations

2D images and sprites

Audio files

3D assets for VFX

Video files

3D scan data

Other

Chart 1.4 shows that both artists and developers are incorporating premade assets into their workflows, using them mostly to create with textures and materials or scripts and code.

In 2023, developers are exploring and trying out new ways to get things done: 63%⁷ of the surveyed devs who are adopting AI tools use generative tech for asset creation.

Peridot by Niantic

To increase our productivity, like many others, we’ve been really looking at AI and seeing how we can use this new generation of tools to empower our designers so they can create new assets to explore new ideas. Also, how we can prototype new ways of characters, bring them to life, and have them animate in new ways.

1.5: Developers harness AI to create NPCs.

Non-playable characters (NPCs)

Creating one-of-a-kind experiences

Speech recognition and natural language processing

Body/object detection or classification

Image, video, or 3D model classification

User-generated content

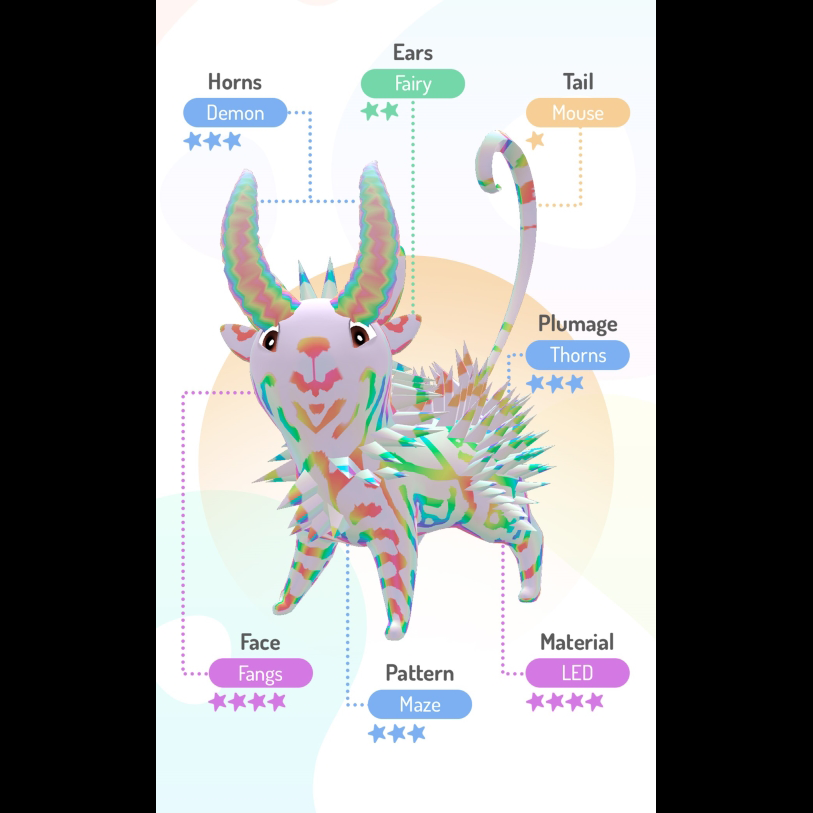

Developers are incorporating AI to immerse players in the game. Our survey⁸ data confirms that 56% of AI adopters use it for worldbuilding, and, as shown in Chart 1.5, 64% of those creators favor it for developing NPCs to populate these worlds.

1.6: AI is most commonly used for AR/VR and online multiplayer games.

AR/VR

Online multiplayer

Casual

Open world

Role-playing

Strategy

Educational

Puzzle

First-person shooter

Prototyping and concepting, asset creation, and worldbuilding explain what studios most commonly adopt AI for, and Chart 1.6 shows what they are creating – 29% of surveyed AI users are making AR/VR games, with online multiplayer games coming in at a close second with 28%.

Job Simulator by Owlchemy Labs

1.7: Lack of time or know-how is the biggest blocker to AI tool adoption.

I have an interest but not enough time

I or my colleagues don’t have the technical skills

I didn’t know that it was possible

I didn’t know the purpose

Other

AI took off in 2023, however, 38%⁹ of the studios that responded to polls say they’re still reluctant to start. Chart 1.7 shows that 43% of surveyed developers who hesitate to try AI are interested but don’t have enough time, while nearly a quarter say they are uncertain they have the technical skills to use it correctly.

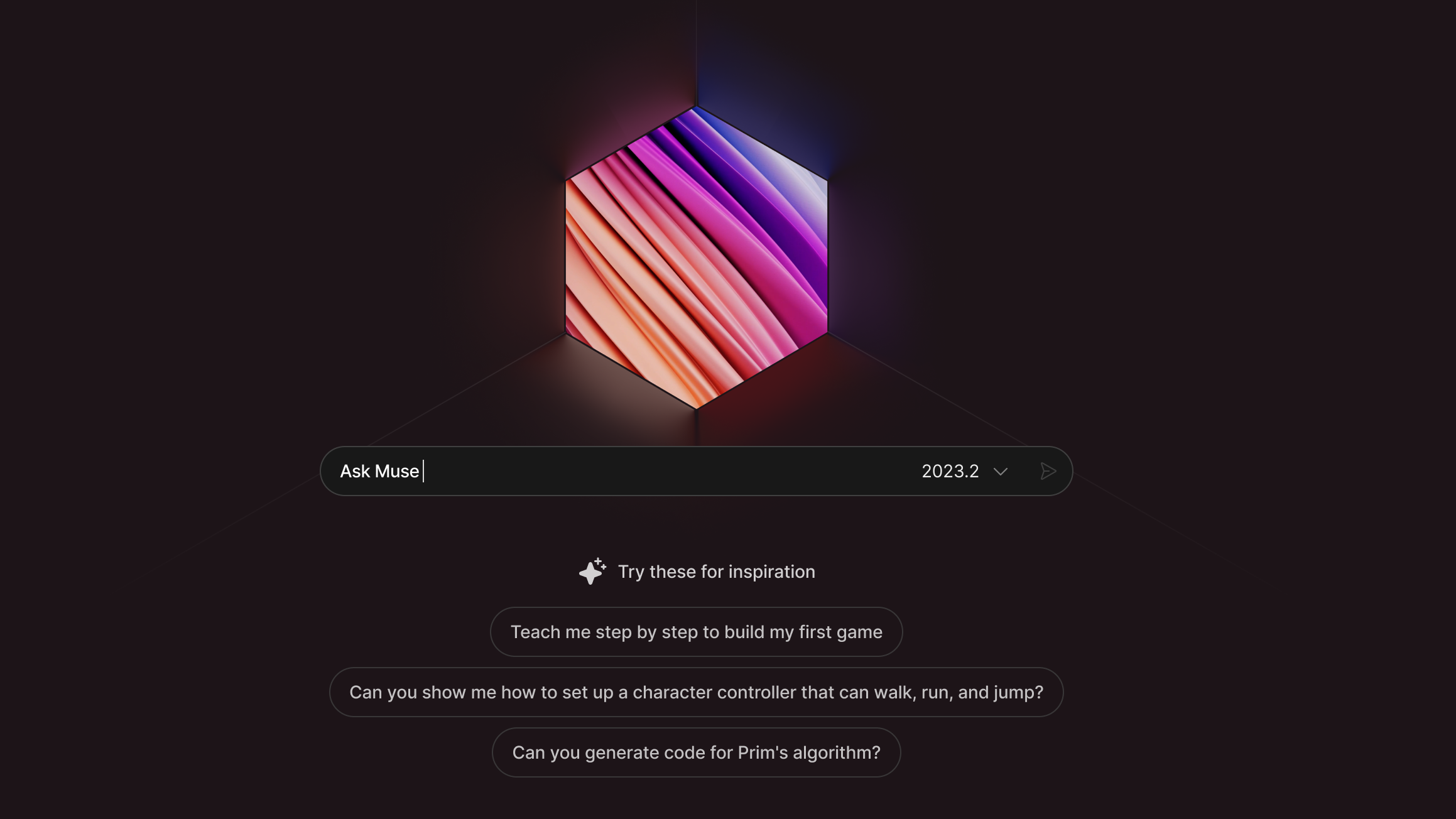

As more demos and documentation become available for AI features like Muse Chat, developers will have the chance to gain further clarity and gauge which solutions might be a good fit for their workflow.

Devs are also looking to boost their efficiency with solutions beyond AI.

Too often, devs report that asset management issues cause delays. As a game’s concept gets closer to reality, focus shifts toward creating and refining the assets that will bring it to life. Chart 1.8 shows that nearly half of the gaming studios we polled work with 1,000+ assets, with midsize and larger studios most commonly working with 1,000 to 5,000 assets.

Warhammer 40,000: Warpforge by Everguild

1.8: Studios work with a lot of assets.

Less than 1,000 assets

1,001 to 5,000

5,001 to 50,000

50,000+

The size of this library brings inefficiencies – 19%¹⁰ of the studios surveyed identify managing content across their organization as an issue, while 18% of indies point to asset duplication as a major pain point.

These obstacles, along with asset versioning, collaboration, and spending too much time searching for assets, contribute to workflow delays. Chart 1.9 shows that 20% of creators polled spend over four hours each week transforming assets’ formats and sizes to use them across different pipelines and applications.

1.9: A look at how studios spend time dealing with assets.

Less than 1 hour

1-2 hours

2-4 hours

4-8 hours

More than 8 hours

1.10: Version control is the most prized feature of a Digital Asset Management (DAM) solution.

Not at all important

Slightly important

Moderately important

Very important

Extremely important

Chart 1.10 shows that surveyed creators believe that asset organization, version control, and asset discoverability are the most important attributes when using DAM solutions like Unity Asset Manager, which reduces friction by automating asset versioning and access.

Cloud services have a lot of things to offer. It will help smaller teams achieve things that were previously only possible for larger teams with dedicated server engineers.

51%¹¹ of studios polled say they are embracing DevOps tools as another time-saving solution.

As Chart 1.11 shows, devs adopt tools like Unity Version Control for better code safety, stability, and quality, as well as to improve security, automation, and go to market faster.

Warhammer 40,000: Warpforge by Everguild

1.11: DevOps tools support code safety and stability.

Improved code safety and stability

Increased security

Automation and efficiency

Code quality improvements

Faster time to market

Improved communication and collaboration

Scale infrastructure and development processes

In the DevOps space, disparate information streams are a challenge, especially when dealing with emerging or live issues. I think teams are hungry to understand interrelationships between data streams, such as stability tracking, live metrics, and user churn, and I could see a greater focus on tools to draw inferences and support looking at what matters, when it matters.

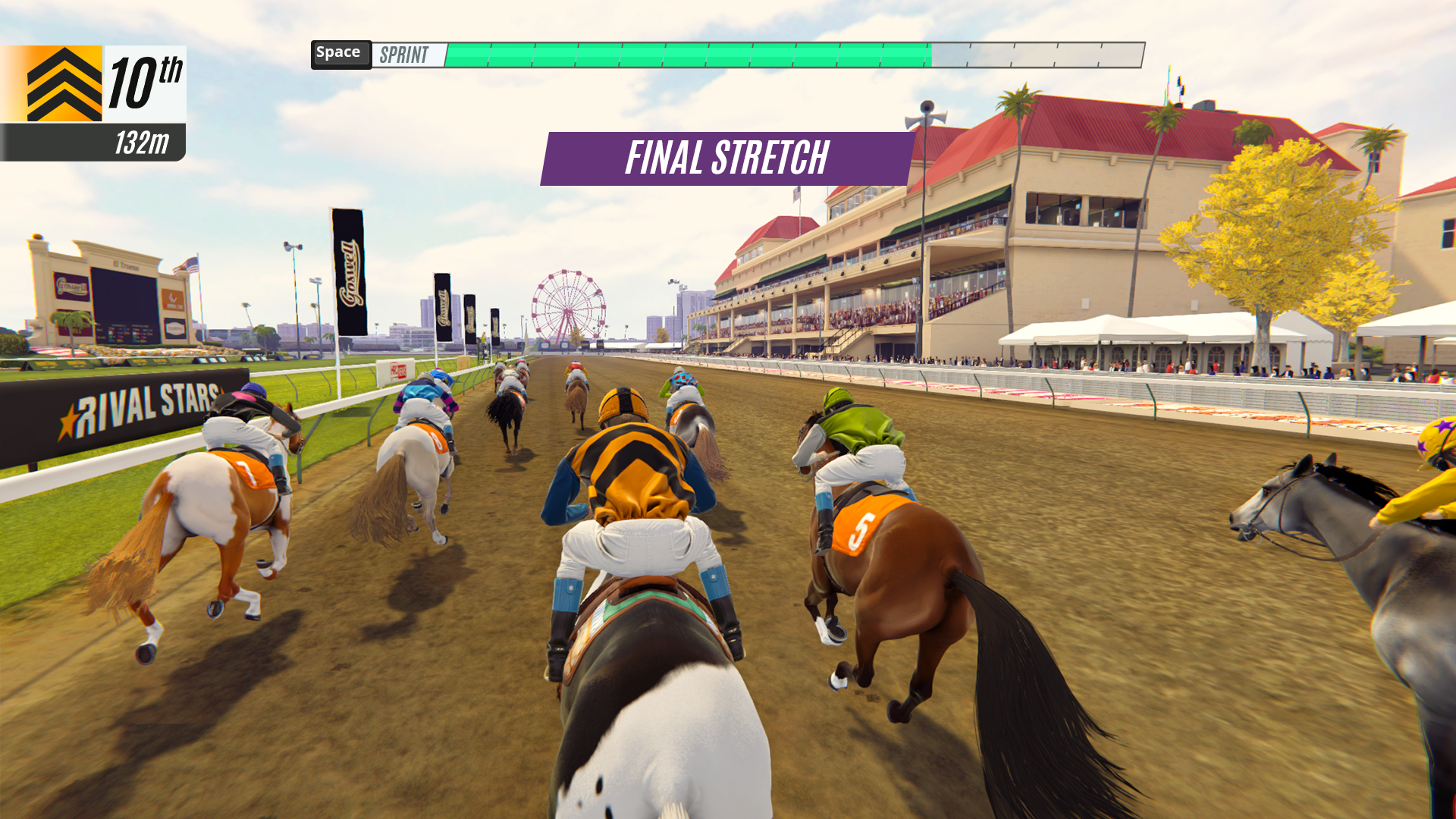

Rival Stars Horse Racing by PikPok

Productivity tips

How AI could help you

Reduce tedious production work

Delegate monotonous tasks like resizing, upscaling, and fixing resolution issues to AI tools so you can focus on what counts.

Prototype in your own style

Generative AI has evolved so that you can not only generate content but also input “style guides” to produce art assets that fit with the look and feel of your project.

Iterate with speed and ease

Quickly generate assets and variations to explore more ideas and find your final version faster.

Find and distill resources quickly

AI can help you locate accurate, relevant resources and distill complex concepts into understandable steps.

Test and troubleshoot code

With features like Muse Chat, you can create code with builds and tests, as well as troubleshoot code you’ve written.

Build innovative new features with AI models

Third-party neural networks can power ambitious features that wouldn’t be possible with traditional coding. Solve complex development challenges and build on-device features like object recognition, dialogue systems, performance optimizations, and more by plugging third-party models into your projects.

Run AI models directly on user devices

New neural engines like Unity Sentis let you leverage end-user device compute (the CPU or GPU) to run AI models, which means they are fast, secure, and run across platforms while reducing your server costs.

Resources

Studios are diversifying their revenue approaches.

Mobile is still going strong. But as the industry shifts, studios are hedging their bets by exploring new revenue streams to support their existing tactics. Many studios with live games are finding that sustaining revenue means tweaking the formula to drive greater retention and engagement. To help build a balanced game economy, the three main revenue channels for free-to-play mobile games are in-app advertising (IAA), in-app purchases (IAP), and offerwall, a user-initiated rewarded marketplace of offers. Each of these streams help create opportunities for players to interact with in-game content in various ways. Increasingly, success means staying close to the data to tailor a mix of tactics by region, game genre, and audience.

- 2.1 Mobile gaming is sustaining growth.

- 2.2 The median mobile player retention is down slightly worldwide.

- 2.3 IAP revenue is down.

- 2.4 In-app purchase payer rates are decreasing.

- 2.5 In-app purchase transactions and average spend per payer remain steady.

- 2.6 IAA revenue is way up year over year.

- 2.7 Simulation, casual, and puzzle games are seeing growth in IAA revenue.

- 2.8 Games with diverse ad strategies show higher engagement.

- 2.9 Games using both rewarded videos and offerwall improve retention.

Here’s how we’ve classified the different markets

Here’s how we measure data

How we measure player retention

2.1: Mobile gaming is sustaining growth.

2021

2022

2023

2023 continues to prove that mobile gaming is still growing. Chart 2.1 shows that worldwide DAU for mobile is up 4.1% in 2023¹², representing a 4.5% increase from 2022’s growth.

We’re really excited about emerging markets. We’ve recently expanded in India and Indonesia, and there’s a lot of excitement from the player bases there. It’s been enlightening to experiment to see what resonates with players.

2.2: The median mobile player retention is down slightly worldwide.

Day 1

Day 7

Players churn out quickly, with Day 1 and Day 7 being the most crucial hurdles to overcome when measuring retention. Chart 2.2 shows that mobile player retention is marginally down worldwide, with a decrease of 1.00% and 0.10% respectively in Day 1 and Day 7 retention.

Competition and the maturity of the market have made it harder to retain players. There are more games than ever, and players have become more selective.

My Talking Angela 2 by Outfit7 Limited

2.3: IAP revenue is down.

2022

2023

2.4: In-app purchase payer rates are decreasing.

2021

2022

2023

Chart 2.4 shows that the percentage of payers has dropped 0.15% between 2021 and 2023¹⁵.

On a different note, Chart 2.5 shows that IAP transactions per payer and average spend per payer have remained steady year over year¹⁶. The data indicates that this cohort of payers is fairly stable, however developers still need to find ways to encourage deeper gameplay and engagement to increase the number of payers and drive revenue.

Sunshine Island by New Moon Production

2.5: In-app purchase transactions and average spend per payer remain steady.

2021

2022

2023

2021

2022

2023

The overall IAP market has gone down slightly this year. I think we are still feeling the post-COVID impacts and are working to find the right audience at the right price.

2.6: IAA revenue is way up year over year.

2022

2023

2.7: Simulation, casual, and puzzle games are seeing growth in IAA revenue.

% of IAA YoY Change

% of IAP YoY Change

In Chart 2.7, you can see IAA’s success in certain game genres, particularly in simulation (41%), casual (33%), and puzzle (31%) games that have experienced a significant increase in daily IAA revenue¹⁹. Data also shows that while there’s opportunity for IAA in some genres with large growth, others are still benefiting from IAP, such as RPG (2%) and shooter (1%) games.

2.8: Games with diverse ad strategies show higher engagement.

Rewarded video and offerwall

Rewarded video only

Offerwall only

No rewarded ads

In 2023, coupling monetization tactics has proven successful.

Chart 2.8 shows that games that include both rewarded videos and offerwall have an average of just over three daily active sessions, compared to a little more than two daily average sessions for games with no rewarded IAA strategy²⁰.

Zooba: Feral Multiplayer Mayhem by Wildlife Studios

There is some strategy to making the most out of your placements. If you have three placements that entice the same kind of user you're probably not making the most money out of your whole portfolio of placements. We are trying to maximize both engagement and the number of ads people watch.

2.9: Games using both rewarded videos and offerwall improve retention.

Rewarded video and offerwall

Rewarded video only

Offerwall only

No rewarded ads

Doubling up on ad formats also helps with retention. As Chart 2.9 shows, games that use both rewarded videos and offerwall retain players better than those without a rewarded strategy, netting an increase of 4% and 2% in Day 7 and Day 30 retention²¹.

Monetization tips

How to increase monetization strategy effectiveness

For in-app purchases (IAP)

Explore different options

The average number of IAP products available per game increased 12.27% YoY to 31, with over a quarter of games using between six and 15 IAP products. Bundle packs (34.1%) and sales (27.8%) lead in popularity.²²

Currencies are a safe bet

49.9% of IAP products are currencies²², signaling a strong economy and player interest.

Find value in bundle packs and limited-time events

Limited-time events show an 8% increase YoY and 8.1% growth as a top-three revenue driver²³. Bundle packs and limited-time events can also be used in an offerwall.

Drive revenue with piggy banks

26.3% more developers report piggy banks as a top-three revenue driver²⁴.

For in-app advertising (IAA)

Test an IAA strategy with varying formats

This can help offset IAP pressures and allow players to interact with premium content in a different way.

Maximize rewarded video (RV) opportunities

An increase in RV surfacing points leads to a higher percentage of players opting into watch RVs, with a sweet spot at 5 and 15²⁵.

Consider context-sensitive and randomized reward systems

Additional moves (30.5%), daily rewards (30.3%), and gacha (31.1%) are the reward systems that yield the highest user engagement²⁶.

Location and timing matter

Where and when you surface an ad is important. In 2023, 38.1% of ad viewer engagement came from surfacing a rewarded ad after a player’s resources have run out. Placing an ad in a pop-up message (25.2%) or in a lobby, map, or pre-level area (25.2%) were also successful strategies.

Offer rewards that help player progression

Additional moves drive the greatest number of rewarded ad watches, at 3.81 views per daily active user.

Resources

Studios of all sizes are shipping to more platforms.

The benefits of shipping multiplatform are clear – more platforms means more potential players. This also adds a lot of risk, overhead, and complexity, but studios of all sizes are increasingly deciding that it’s worth it. Last year’s trends report showed a bump in larger studios releasing on more platforms, and this year sees smaller indies going for the same gains. With less investment and increased competition, studios are maximizing whatever resources they have for the greatest possible ROI.

- 3.1 Smaller studios are shipping more games on multiple platforms.

- 3.2 More games are launching on 3+ platforms.

- 3.3 Studios plan multiplatform strategies early.

- 3.4 Mobile and desktop are more popular with studios of fewer than 50.

- 3.5 Developers are split on multiplatform rollout strategies.

- 3.6 RPGs lead in multiplatform development.

- 3.7 Developers are prioritizing cross-platform play.

3.1: Smaller studios are shipping more games on multiple platforms.

Number of multiplatform projects

Number of multiplatform projects by small studios

Chart 3.1 shows that the proportion of multiplatform games has grown 40%.

While small studios largely stuck to single-platform release strategies in 2022, they’ve built 71% more multiplatform games over the past two years²⁷.

Greak: Memories of Azur by Navegante

Smaller studios are shipping on multiple platforms since it’s been easier to do so using tools like what Unity provides for us. Platform holders are also helping, giving expertise and development kits to indie studios to launch on multiple platforms. I think that’s helped tremendously.

3.2: More games are being built on 3+ platforms.

2022

2023

In an attempt to increase awareness and potential audience, studios are looking to be where players are by bringing their games to as many platforms as they can.

As shown in Chart 3.2, there has been a 34% increase in games launching on three or more platforms between 2022 and 2023.

CONV/RGENCE: A League of Legends Story by Double Stallion Games

Launching on multiple platforms has definitely become more accessible because of the tools that are available. When thinking about what platforms to consider, the biggest concern that we have is if we can deliver a playable experience on that platform. It’s also about performance. Can we get the right fidelity, graphics, and frame rate on the target platforms?

3.3: Studios plan multiplatform strategies early.

Day one

Preproduction

Production

When deciding to build a multiplatform game, there are many elements to consider – platform choice and partners, pertinent tools and features, design and performance optimization, marketing strategy and rollout, and more.

Another factor to take into account is when to start thinking about all of these elements. Some studios focus on building the game for a primary platform and worry about adding on once the game is further in development, while others keep multiple platforms in mind from the beginning.

Chart 3.3 shows that 55% of studios surveyed are starting to plot their multiplatform strategies during preproduction, while lower–midmarket studios are most likely to start from day one.

Greak: Memories of Azur by Navegante

Start thinking about your multiplatform strategy as soon as you have a stable build that you are confident to show at events. That way, you can get feedback from players on where they want to see it launch. You can also speak to different platforms and people that are at the event to see if there’s a good opportunity to work together.

3.4: Mobile and desktop are more popular with studios of fewer than 50.

Mobile

Desktop

Console

VR

Web browser game

Social network game

Chart 3.4 shows that surveyed studios with fewer than 50 team members are mainly targeting mobile and desktop platforms.

PC tends to be our first port of call for a couple of reasons. It’s generally easier to just build for PC, first, because everyone’s working on PC, and it’s easy to get a build back onto a PC. Also, when it comes to trying to define metrics for everything, for example, when you’re pitching, it’s easy to collect data for PC titles.

Once a studio has chosen platforms for a game, the next major decision is how to release it.

While a simultaneous rollout can take longer and requires more upfront investment and multitasking, releasing a game simultaneously across targeted platforms increases its potential player base immediately.

On the other hand, a staggered release can give a studio the opportunity to strengthen the game’s design, gameplay, performance, platform partnership, and marketing strategy, while providing important feedback to optimize for additional platforms.

Southfield by Radical Forge

3.5: Developers are split on multiplatform rollout strategies.

Simultaneous rollout

Staggered rollout

No rollout strategy

Chart 3.5 shows that studios of all sizes that polled favor simultaneous and staggered rollouts evenly.

I think a lot of smaller studios are launching on a lot of platforms at the same time because it helps in getting exposure while taking advantage of content creation efficiencies.

Breachers by Triangle Factory

3.6: RPGs lead in multiplatform development.

When deciding on a single or multiplatform release, game genre is another important factor to consider.

Chart 3.6 shows that 38% of multiplatform developers surveyed are making role-playing games, followed by shooter and fighting games at 33%.

Project Z by 314 Arts

When we consider publishing on other platforms, we look at how other games in our genre perform on those platforms, and check if maybe there’s a market for the game that we want to create in the future.

3.7: Developers are prioritizing cross-platform play.

1–9 people

10–49 people

50+ people

Chart 3.7 shows that almost all studios polled are choosing to develop their games for cross-platform play: In 2023, 95% of studios with 50+ people choose to prioritize this feature set.

Our data²⁸ also shows that in 2023, 91% of multiplatform games can be played across platforms.

Demeo by Resolution Games

Cross-platform is something that a lot of players are expecting games to be right now, and from a developer point of view, it’s something that is actually very technically complex. People want to play with other people on whatever platform they’re on. So Unity is a really spectacular tool for making that happen, and taking a lot of that complexity away.

Multiplatform gamedev tips

How to maximize your multiplatform game development

Find resources that can be used across platforms

Multiplatform development comes with many obstacles, and resources like URP 3D Sample Scene help you explore tools that work across desktop, console, mobile, and XR.

Profile and debug. And then rinse and repeat

Nailing your optimization process is essential to smooth multiplatform game development. Profiling and debugging tools like the Unity Profiler, Memory Profiler, and Frame Debugger, help you measure performance, test against target hardware memory limitations, and improve CPU/GPU performance across platforms.

Prioritize platform relationships

Apply to closed platforms early on in your game development journey to become a registered developer and secure your connection to key developer resources. Platform relationships can help your game reach audiences on PlayStation 5, Xbox Series X|S, and Meta Quest 3.

Resources

Devs prioritize multiplayer despite greater complexity and cost.

In 2023, developers are staying focused on multiplayer games. While there are more out-of-the-box templates, tools, and services on the market to simplify multiplayer development, it’s still more challenging than building single-player games. But multiplayer offers the potential for greater engagement and reduces the need to keep games fresh with new content since other players make each round feel different. But the biggest reason devs focus on multiplayer? It’s what gamers want.

- 4.1 Mobile gamers want multiplayer features.

- 4.2 Studios are focused on multiplayer games.

- 4.3 Most multiplatform games are multiplayer.

- 4.4 Developers start planning their multiplayer infrastructure early.

- 4.5 Budget is the most common challenge of multiplayer community engagement.

- 4.6 Developers think players want easy communication above all.

- 4.7 Multiplayer gaming revenue continues to rise.

4.1: Mobile gamers want multiplayer features.

Single-player games

Multiplayer games

As shown in Chart 4.1, on average, mobile-only games containing some multiplayer features had 40.2% more monthly active users than those without²⁹.

4.2: Studios are focused on multiplayer games.

Multiplayer

Single-player (network gameplay)

Single-player (no network gameplay)

Couch co-op

Chart 4.2 shows that 68% of studios polled say they are developing multiplayer games, including same-device couch co-op titles.

Multiplayer games have become more popular because new technologies help make them easier to build and allow more people online to play. The increase in games means more competition, which leads to higher quality.

Talking Tom Hero Dash by Outfit7 Limited

4.3: Most multiplatform games are multiplayer.

Multiplayer

Single-player (network gameplay)

Single-player (no network gameplay)

Couch co-op

As shown in Chart 4.3, 76% of the developers surveyed are creating multiplayer games, including couch co-op games, for two or more platforms in hopes of broadening their player bases.

As competition and market saturation increases, it’s harder to succeed with a multiplayer game. It’s attractive to be on as many platforms as possible to be able to meet players, and their friends, wherever they are throughout the day. You want to make it as convenient as possible for them to reach for the game.

My Talking Angela 2 by Outfit7 Limited

4.4: Developers start planning their multiplayer infrastructure early.

Day one

Preproduction

Production

Testing

Prelaunch

Launch

Although multiplayer games are more within reach than in the past, increased competition makes it harder for a game to stand out.

To ensure they have the best chance for success, creators prefer to get a head start. As shown in Chart 4.4, 62% of surveyed developers say they start planning their multiplayer games by the end of preproduction.

Demeo by Resolution Games

4.5: Budget is the most common challenge of multiplayer community engagement.

Limited budget

Volume of feedback to analyze or respond to

Limited staff

Lack of technology

Multiplayer functionality not only introduces additional code, design, and testing intricacies; it also requires more work to manage community sentiment which, in turn, can bring more development costs.

Chart 4.5 shows that 53% of multiplayer developers polled identify a limited budget as the biggest challenge for community management, while 47% have trouble analyzing and responding to the volume of feedback they receive.

Toca Life World by Toca Boca

4.6: Developers think players want easy communication above all.

Easy communication

Lag-free experience

Fair matchmaking

Shared progression

Cheater-free

One friends list

Chart 4.6 shows that 38% of creators surveyed identify easy communication as the most worthwhile feature for players of multiplayer games.

While communication is key, players also want a smooth playing experience. 37% of developers highlight a lag-free connection as one of the most valuable elements for gamers.

Multiplayer games on mobile are all about community solutions. Having the opportunity to play with friends on their phones and communicate all throughout the day keeps people engaged and coming back to your game. Word of mouth and player adoption of your game also become easier.

My Talking Tom Friends by Outfit7 Limited

4.7: Multiplayer gaming revenue continues to rise.

2022

2023

2024

As Chart 4.7 shows, multiplayer gaming revenue grew roughly 10% in 2023, with a predicted growth of 7% in 2024. Those numbers might not look like much, but that 10% represents roughly $2.3B, highlighting the value and potential of multiplayer games.

Multiplayer gamedev tips

How to scale your multiplayer game

Find the fun fast and keep iterating

Rapid prototyping is the name of the game. Once you’ve got an idea, get it in front of players as soon as possible to gauge their interest and gather feedback. When you’ve got a winner, build testing and optimization into your roadmap.

Don’t underestimate the cost of re-architecture

If you’re building a multiplayer game, start thinking about your networking and hosting tools like Unity Netcode solutions and Game Server Hosting as early as possible. Re-engineering your game in later stages of development can be costly.

Prioritize performance

Building low-latency games is expensive and complex. Keep an eye on your server and CPU costs throughout the development process using features like the Unity Profiler.

Player communication is key

Enabling more cooperative and competitive multiplayer experiences using a communication solution like Voice Chat (Vivox) can improve player engagement.

Consider player retention and community health

Both building multiplayer games and acquiring new players are challenging and expensive. Keep your players happy by listening to them, addressing their concerns, and ensuring that you maintain a quick and efficient feedback loop.

Resources

The industry is building stronger brands by extending engagement.

There’s no such thing as ‘set it and forget it’ in game development. It’s essential to start planning live ops, content rollout, and update strategies right from the start. Live ops are crucial to driving retention, and it’s really hard to get players back after they’ve left a game. Creators are taking more risk-averse approaches to game maintenance and updates, looking for ways to attract long-term brand loyalty by focusing on IP that has already proven successful and maximizing its potential. But they’re also increasingly exploring newer tactics, like user-generated content, to get more value out of what they already have. This means that devs are aware of how important it is to continuously evolve their strategies to ensure constant curiosity and a deep level of engagement from their players. So, while a sure thing is attractive, it’s essential to ensure that you constantly work to maintain relevance and avoid solely relying on prior wins.

- 5.1 Developers begin planning live services between production and pre-launch.

- 5.2 Studios test more markets and offer new content frequently.

- 5.3 Most developers update their games for one to two years.

- 5.4 Players are making devs take toxic communities seriously.

- 5.5 Studios favor daily rewards and missions as engagement techniques.

- 5.6 User-generated content is a hot topic.

- 5.7 Live ops services take an average of four months to see significant use.

5.1: Developers begin planning live services between production and pre-launch.

Day one

Preproduction

Production

Testing

Prelaunch

Launch

Post-launch

Not typically considered

Implementing engagement and retention tactics is paramount for a live ops strategy, and making data-backed decisions is key. Developers agree and are using 44% more analytics services than in 2022³⁰.

We’re a free-to-play game, so we are going to be planning how we’re going to keep people retained, how we do our events, and our analytics early on. However, it’s still an evolving learning journey as to how and when to respond to those analytics in the right and most efficient way.

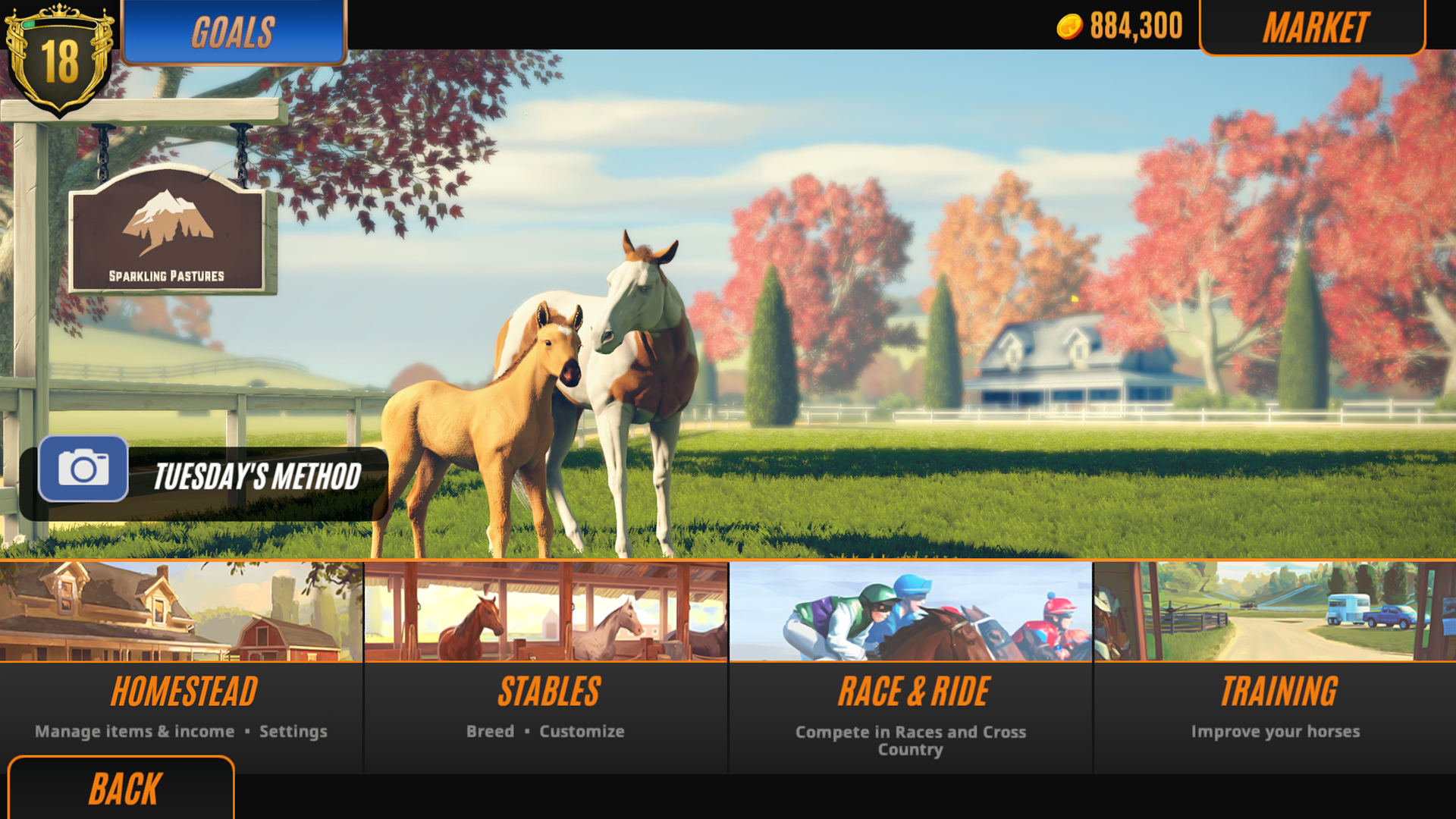

Rival Stars Horse Racing by PikPok

5.2: Studios test more markets and offer new content frequently.

Targeting new markets with existing IP

Consistently delivering new game content

Finding solutions to work smarter

Diversifying game portfolio

Focusing on player retention

Investing more in monetization and user acquisition

No change in operations

As industry investment contracts, studios are looking to diversify their tactics to maximize their potential for success.

Chart 5.2 shows that 53% of studios polled are targeting new markets with existing IP, and 52% are consistently delivering new content to attract and retain players.

Toca Life World by Toca Boca

5.3: Most developers update their games for one to two years.

Under six months

Six months to a year

One to two years

Three to five years

90%³¹ of players surveyed have an appetite for downloadable content, and developers are making great efforts to serve it up.

Chart 5.3 shows that most devs surveyed say they are updating their game content for one to two years post-launch.

Subway Surfers by SYBO

The community is the life blood of evergreen games. It’s something that you need to cultivate and encourage. Part of doing that is ensuring they have regular fresh content. For Subway Surfers, we have a three-week content update cycle that works really well for us.

5.4: Players are making devs take toxic communities seriously.

As Chart 5.4 shows, 34% of players surveyed go as far as leaving a toxic game. Developers are turning to solutions like Safe Voice to manage problematic behaviors in their communities.

Toxicity in multiplayer VR is a big problem. When you’re looking at lobby or matchmaking tools, I think it’s very difficult, but important. It’s something that as the developer you need to address because your players shouldn't have to have a toxic environment forced on them.

Job Simulator by Owlchemy Labs

5.5: Studios favor daily rewards and missions as engagement techniques.

Daily rewards and missions

Achievements and challenges

Rewarded ads and/or in-app purchases

Leaderboards

Player vs Player

User-generated content

Timed events

Social features

Out-of-game engagement

Chart 5.5 shows that developers polled are hoping that the high-effort, high-reward trend continues, with 67% preferring to implement daily rewards and missions, and 59% offering achievements and challenges.

5.6: User-generated content is a hot topic.

Considering user-generated content

Do not include user-generated content

Include user-generated content

Chart 5.6 shows that 39% of surveyed developers have user-generated content in mind, so this rising trend is likely to persist.

Part of maximizing the player base of an IP is not only being where the gamers are, but also giving them what they want. And players want to engage creatively with game worlds. In a recent survey³², 52% of U.S. gamers say that the ability to generate content gets them to play longer, while 34% would make content. 31% say they would spend more money on downloadable content on a game with UGC.

Subway Surfers by SYBO

User-generated content is going to be a big trend going forward. It’s definitely the hot thing that everyone is trying to nail down in the mobile space, but in every other category as well. Community teams want to engage, and players want to put themselves into the game they love.

5.7: Live ops services take an average of four months to see significant use.

Total runtime API usage

Average builds

It’s essential to ensure that the API is implemented by launch day, since Chart 5.7 reveals how, on average, it takes 112 days for developers to report significant usage of 5,000 runtime API calls or more for live ops services on launched games³³.

Depending on how production went, we see use of our live ops features after the first few updates have been shipped. Typically, it takes about three or four months after our global launch for usage to seriously kick in.

My Talking Tom 2 by Outfit7 Limited

Game engagement and longevity tips

How to keep players engaged

Keep fresh content coming

Updating content regularly is a good way to help games stay top of mind and keep players coming back for more. Tools like the Unity Addressable Asset System help simplify content pack creation and deployment to keep frequent content updates from being overwhelming.

Make data-based decisions

In order to improve player experience, it’s important to get data-driven insights about your game and player behavior. Tools like Unity Analytics help you learn about specific habits and outcomes so you can make the best decisions for your players.

Put community at the heart of games

Finding different ways to interact with players is key to a game’s lifespan. Resources like user-generated content and social media help sustain your connection with your community and keep them engaged with each other.

Listen to player feedback, and close the loop

The gaming industry is more competitive than ever, and players have limitless choices. So if a player makes the effort to reach out with constructive feedback, it’s crucial to listen and validate the effort. Even if it’s out of your control or a request you’re not able to accommodate, making an effort shows the care and respect that you have for your community.

Resources

Taken all together, it feels like studios are simultaneously prioritizing staying safe and being bold – they need to stretch resources, but want to make sure they get the most out of what they have. They’re exploring new ways to strengthen their businesses and shore up ROI, but without adding risk.

Considering all of this and the external factors already clear on the horizon – more AI tools, ongoing investment decline, and shifts in players’ tastes – here’s where we see things going from here.

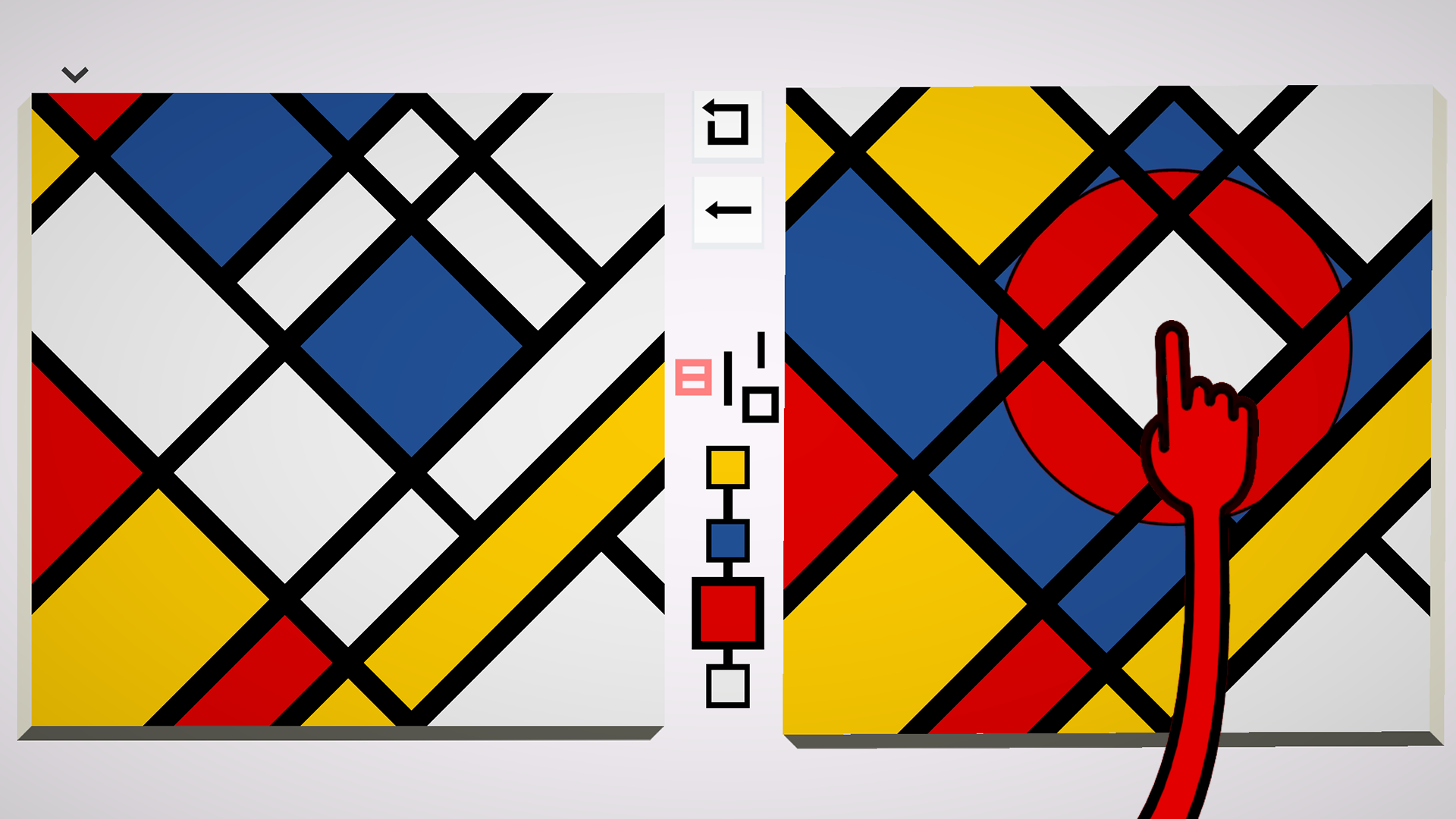

Please, Touch the Artwork by Studio Waterzooi

Here are five trends that we predict will shape 2024 and beyond.

AI use in the gaming industry will deepen and become normalized.

Generative AI will continue to help make game development achievable. We expect that it will lower the threshold for implementing user-generated content, and AI will bring innovation to story-driven gameplay.

Mobile studios will continue expanding to PC and consoles.

With developers’ increasing interest in existing IP and cross-platform multiplayer development, we anticipate that mobile-focused studios will embrace multiplatform development.

There will be greater demand for extended reality games.

We expect that new hardware like the Meta Quest 3 and Apple Vision Pro will entice developers and players to test out new VR and spatial computing experiences.

Developers will explore new business models and revenue streams.

With harder-to-access investment capital, a changing ad market, and shifts in player spending, studios might need to continue rethinking systems that worked well in the past.

Cloud services will become integral to games by improving studio efficiency.

Developers will lean more heavily on cloud services to ease workflows and accelerate games’ time to market.

What is your number-one tip for gamedevs?

What should game developers be talking about this year?

What do you think the biggest trend will be?

About Unity

Unity is the world’s leading platform for creating and growing interactive, real-time 3D (“RT3D”) content and experiences. Our comprehensive set of software and AI solutions supports content creators of all sizes through the entire development lifecycle as they build, run, and grow immersive, real-time 2D and 3D content and experiences for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. For more information, visit Unity.com.

For more information, visit unity.com/games.

Tell us what you think of this report by filling out our short survey.

Unity uses its website (investors.unity.com), filings with the SEC, press releases, public conference calls, and public webcasts as means of disclosing material nonpublic information and for complying with its disclosure obligations under Regulation FD.

Forward-looking statements

This publication contains “forward-looking statements,” as that term is defined under federal securities laws, including, in particular, statements about Unity's plans, strategies and objectives. The words “believe,” “may,” “will,” “estimate,” “continue,” “intend,” “expect,” “plan,” “project,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to risks, uncertainties, and assumptions. If the risks materialize or assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Further information on these and additional risks that could affect Unity’s results is included in our filings with the Securities and Exchange Commission (SEC) which are available on the Unity Investor Relations website. Statements herein speak only as of the date of this release, and Unity assumes no obligation to, and does not currently intend to, update any such forward-looking statements after the date of this publication except as required by law.

¹[Source: Internal Editor Analytics] [Disclaimer: Measures the users of the Editor in the 12 months ending December 31st 2023]

²[Source: Unity Ads event data] [Disclaimer: Based on impressions from January 2023 to December 2023.]

³[Source: Cintᵀᴹ survey 2023, 300 respondents]

⁴[Source: Unity Editor Analytics and Apptopia] [Disclaimer: Based on internally available data from Unity Editor and Apptopia.]

⁵[Source: Cintᵀᴹ survey 2023, 300 respondents]

⁶[Source: Unity Sentis beta user survey 2023, 7,062 respondents]

⁷[Source: Unity Sentis beta user survey 2023, 7,062 respondents]

⁸[Source: Unity Sentis beta user survey 2023, 7,062 respondents]

⁹[Source: Cintᵀᴹ survey 2023, 300 respondents]

¹⁰[Source: Asset Management & Collaboration survey 2023, 120 respondents]

¹¹[Source: Cintᵀᴹ survey 2023, 300 respondents]

¹²[Source: Unity Analytics BigQuery] [Disclaimer: Based on median DAU by app with over 1,000 average daily players.]

¹³This data reports on over 9,300 games using IAP.

¹⁴[Source: Unity Analytics BigQuery] [Disclaimer: Based on games using Unity Analytics with over 1,000 daily active users and over $1,000 in daily IAP revenue, the median IAP ARPDAU is down.]

¹⁵[Source: Unity Analytics BigQuery] [Disclaimer: Based on games using Unity Analytics with over 1,000 daily active users, the median IAP payer ratio has decreased.]

¹⁶[Source: Unity Analytics BigQuery] [Disclaimer: Based on games on Unity Analytics with over 1,000 daily active users and over $100 of IAP revenue per day, the median results have near-flat trends.]

¹⁷[Source: Levelplay and Unity Analytics] [Disclaimer: Based on games using Unity LevelPlay, average in-app advertising revenue per person has increased year over year.]

¹⁸This data reports on over 200 games using Unity Ads, IAP, and analytics solutions.

¹⁹[Source: Unity Levelplay and Unity Analytics data] [Disclaimer: Year-over-year growth in average daily IAA revenue for games using Unity LevelPlay and Unity Analytics, average daily ARPDAU (as a percent of total IAP and IAA ARPDAU.)]

²⁰[Source: Unity Analytics BigQuery, TapJoy BigQuery] [Disclaimer: On average, daily active sessions per user is higher for games that use rewarded video and Offerwall products than games that use one or neither. Based on data between June 2023 and December 2023 and games with at least 5,000 daily active users.]

²¹[Source: Unity Analytics BigQuery, Tapjoy BigQuery] [Disclaimer: Games using Unity Analytics and a combination of Unity Ads and/or Tapjoy Offerwall, having at least 5,000 daily active users. Based on data between June 2023 and December 2023.]

²²[Source: Unity BigQuery] [Disclaimer: Based on data from January 2023 to June 2023, apps that use Unity IAP plugin, apps with at least $1,000 in IAP revenue, and IAP products with at least $10 in IAP revenue.]

²³[Source: Unity BigQuery.] [Disclaimer: Comparing the first 6 months of 2022 to the first 6 months of 2023. Specifically apps that use Unity IAP plugin, apps with at least $1,000 in IAP revenue, IAP products at least $10 in IAP revenue, and top 3 IAP products within each app.]

²⁴[Source: Unity BigQuery] [Disclaimer: Comparing the first 6 months of 2022 to the first 6 months of 2023. Specifically apps that use unity IAP plugin, apps with at least $1,000 in IAP revenue, IAP products at least $10 in IAP revenue, and top 3 IAP products within each app.]

²⁵[Source: Unity LevelPlay data] [Disclaimer: Based on July 2023 data, excluding games that are only set up for "default" placement on LevelPlay. Specifically apps with at least 5,000 DAU, $50 in daily RV revenue.]

²⁶[Source: Unity LevelPlay data] [Disclaimer: Based on July 2023 data, excluding games that are only set up for "default" placement on Unity LevelPlay. Specifically apps with at least 5,000 DAU, $50 in daily RV revenue.]

²⁷[Source: Editor Analytics] [Disclaimer: Data limited to LTS version, teams of 2-50 people, and 2021 onwards.]

²⁸[Source: Cintᵀᴹ survey 2023, 300 respondents]

²⁹[Source: Unity Analytics and App Store] [Disclaimer: Based on internally available median MAU figures of games that used Unity Analytics in 2023.]

³⁰[Source: Internal Editor Analytics] [Disclaimer: Using analytics defined as importing an analytics-related package in the Editor.]

³¹[Source: The Harris Poll’s The State of Toxicity & Cross-Platform Play in Today’s Multiplayer Games: 2023 Edition, 407 respondents]

³²[Source: The Harris Poll’s The State of Toxicity & Cross-Platform Play in Today’s Multiplayer Games: 2023 Edition, 407 respondents]

³³[Source: Unity Game Gateway] [Disclaimer: Significant use is determined as over 5,000 runtime API calls since the initial install.]

2024 Unity Gaming Report

Unlock trend analysis backed by rich data, practical tips from studios, and actionable insights on how to use this information effectively in your development planning and operations.